Travel and work location tracking

Topia’s travel and work location tracking solution provides an audit-ready system of record, capturing where work is actually happening so your organization can remain compliant.

Effectively manage the risks posed by traveling and distributed employees

Our technology can ascertain and log employee work location by pulling from a range of data sources depending on your organization’s preference. This data gives you visibility as to where work is actually taking place, allowing you to mitigate risk exposures.

How knowing employee locations can enhance compliance and reduce costs

How are businesses using our travel and work location tracking solution?

To gain visibility into employee work locations

Know where all your employees are working from, whether they are on a work trip or working hybrid somewhere other than their designated office. The solution provides an audit-ready single source of truth for your employee work locations.

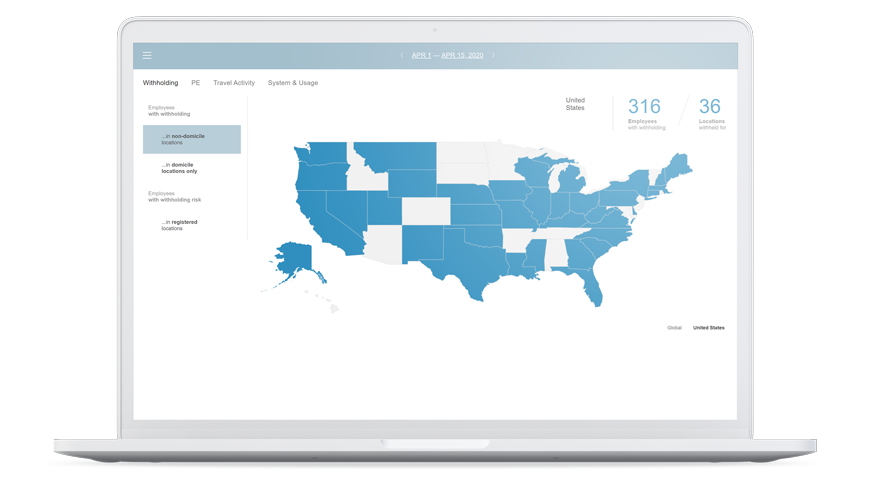

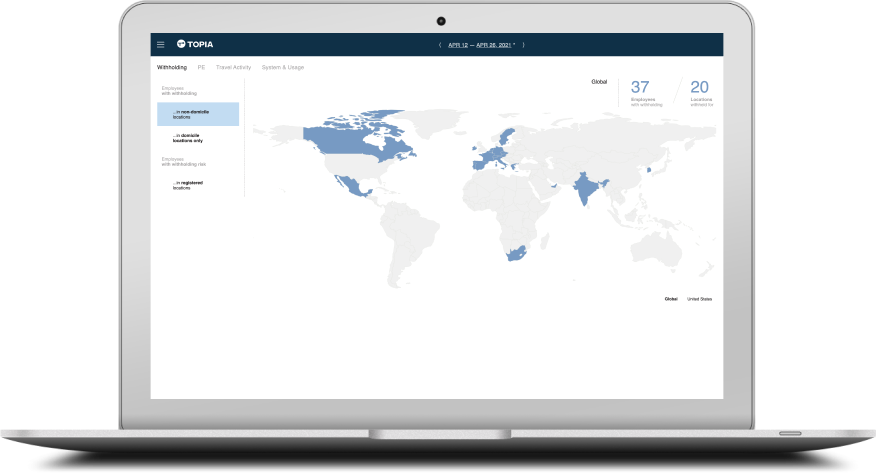

For accurate cross-border and global payroll withholding

Use our solution to more easily calculate non-resident payroll withholding apportionment across US state borders (domestic withholding) or when travelers are moving between countries (international withholding). Topia’s technology makes it simpler to deliver the required data to your payroll provider.

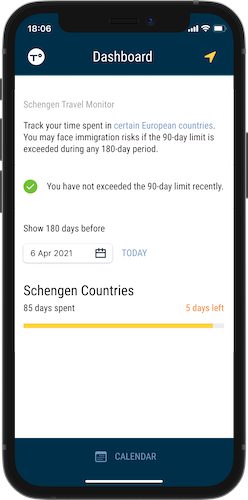

To comply with Schengen Area rules

Track travel days across Schengen Area countries to ensure employees from non-EU countries stay compliant with Schengen Area rules.

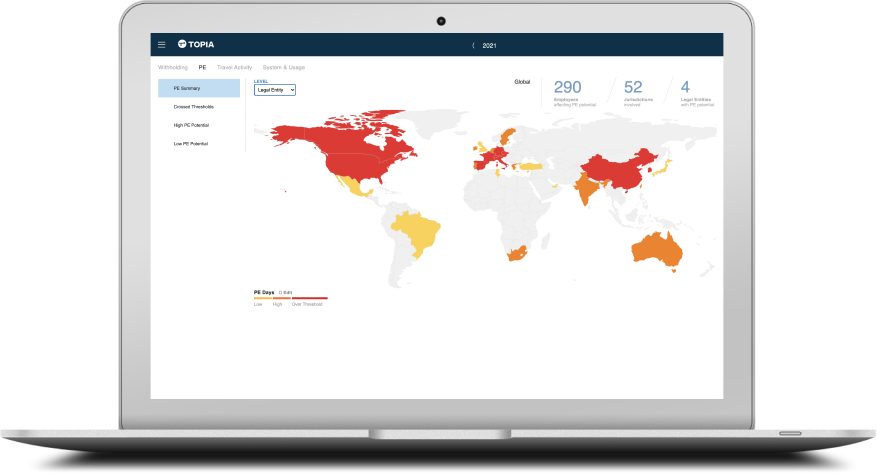

To mitigate permanent establishment risk

Manage permanent establishment risk globally by receiving early visibility into which employees are performing work that may create nexus in a given location.

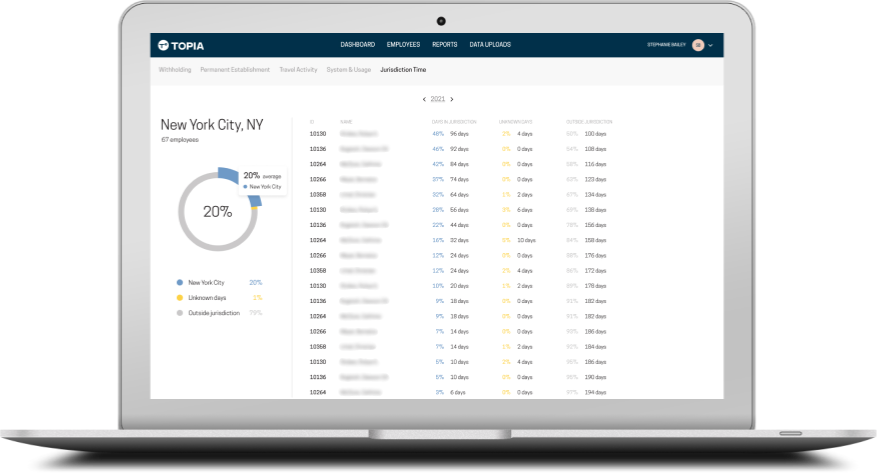

For jurisdiction time monitoring to pay accurate taxes

Certain businesses in particular cities, such as asset management firms in New York, are subject to city taxes based on where work is taking place. By tracking working days in and out of city jurisdictions, these organizations can make sure they aren’t overpaying on city taxes such as UBT in New York.

How the solution works

Track employee locations using multiple data sources

Companies can choose from a range of data sources to track employee work locations. Data can be fed into the Topia system from travel and expense systems such as SAP Concur and BCD Travel or mobile apps can be downloaded by employees onto their mobile devices to reduce manual location self-reporting.

Create configurable risk thresholds and alerts

Configurable limits can be set that accurately reflect your company policies, including defined tax rules and de minimis thresholds. As location data builds up, alerts will warn of growing risks before limits are reached, helping you avoid unexpected taxable events.

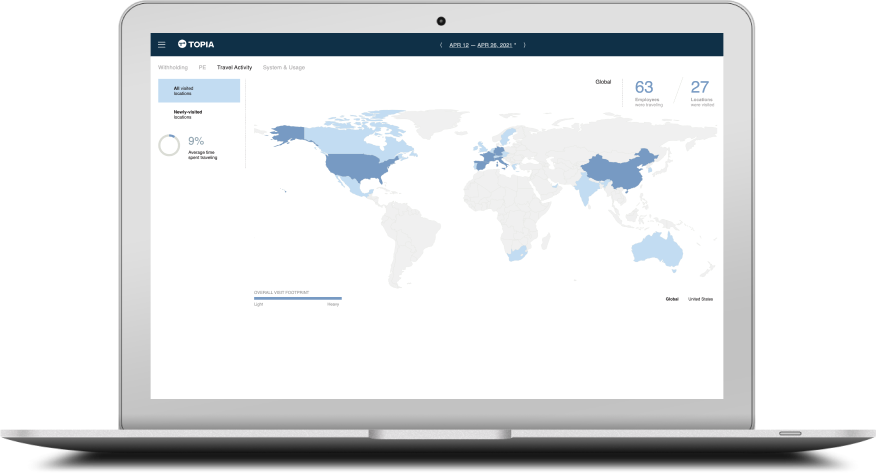

Use dashboards and reporting to understand trends

Instantly accessible reports provide the data needed for internal auditors or tax authorities. In addition, travel dashboards can be used to provide full visibility into employee locations and powerful analytics help identify “accidental expats,” and other risks.

Learn more

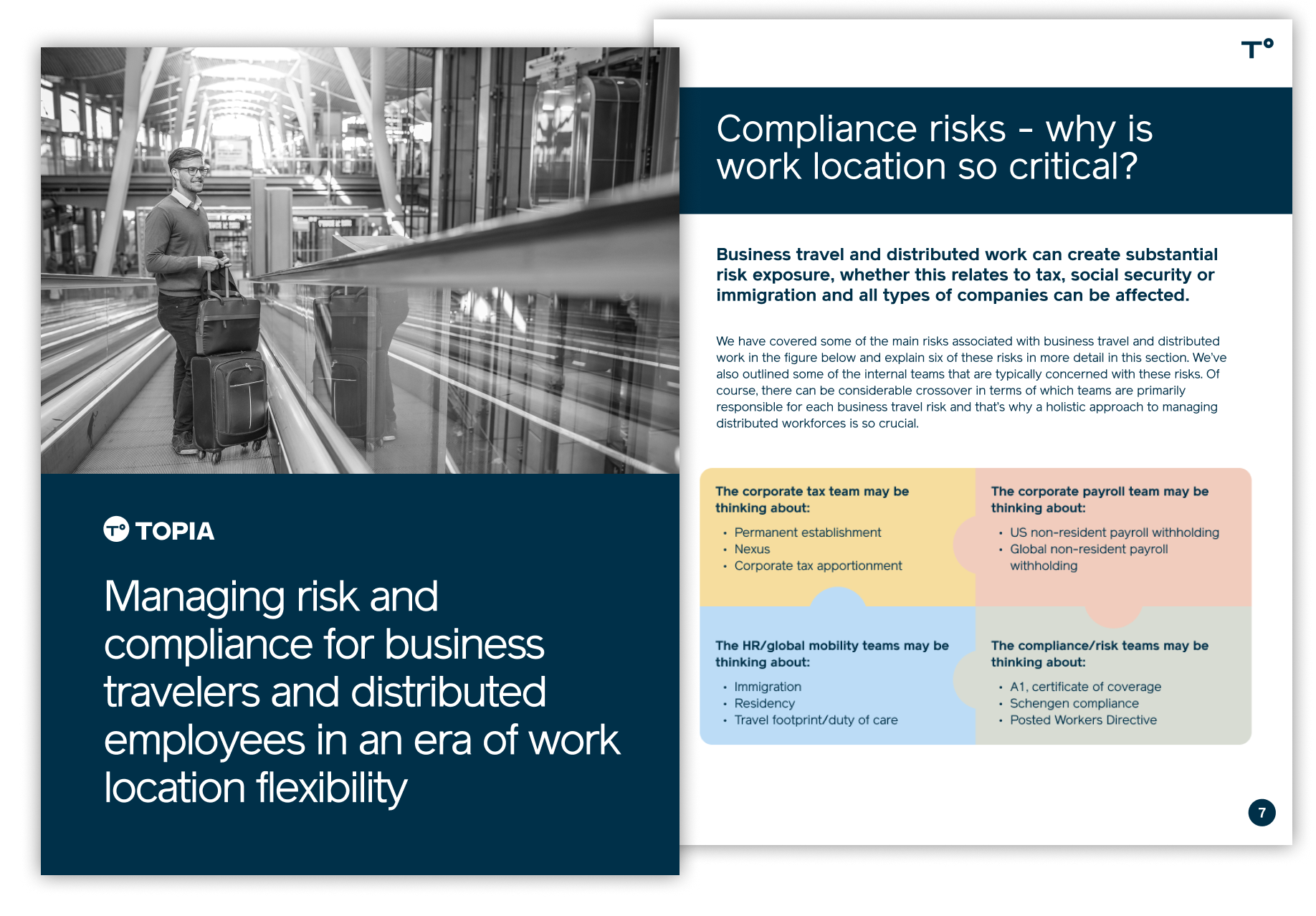

Find out more about managing business travel and distributed work compliance risks using technology in our recent ebook.

Supporting all teams involved in business travel compliance

For global mobility

Global mobility teams are increasingly supporting business travelers and other types of distributed workers. Topia’s travel and work location tracking gives you data and tools to ensure your mobile employees have a great experience while your organization is protected from key risks.

How Topia helps

- Dashboards show global employee travel patterns in real time.

- Powerful analytics identify “accidental expats” and other risks.

- Early alerts warn as employees approach limits.

- Reports give you the data you need for internal auditors or tax authorities.

- Web and mobile apps for mobile employees.

For tax and finance

Business travel and distributed work can create a range of tax risks for companies. Recent research we conducted with finance professionals revealed that half of them felt that inefficient processes for tracking international employees were a challenge for their organization. In the same survey, 75% of finance executives said their team spent 3 to 6 hours every week mitigating risks related to distributed or traveling workers.

How Topia helps

- Managing permanent establishment/nexus risk and corporate tax apportionment.

- Customizable rules and limits to reflect your company’s policies.

- Dashboards show employee locations at a glance.

- Alerts warn you of growing risks before limits are reached so you can take action.

For payroll

Managing multi-jurisdiction payroll withholding can be time-consuming for payroll teams. Topia’s technology can streamline processes and give payroll teams the data they need.

How Topia helps

- Manage your multi-jurisdiction withholding more effectively.

- Flexible controls let you define tax rules and de minimis thresholds.

- Allocate payroll accurately every pay cycle.

- Integration with your payroll processor.

For traveling or distributed employees themselves

Improve the experience of traveling or distributed employees by removing the manual burden of self-reporting locations while protecting against unforeseen tax liability.

How Topia helps

- Web and mobile apps to remove manual admin work for business travelers.

- Access for administrative assistants.

- A verifiable audit trail for all travel and distributed work.

- Visibility of your location in case of emergency.

“One key area Topia’s solution helps us with is our US state-to-state tax tracking to ensure we can do our payroll withholding accurately. We also use Topia’s work location tracking data to help address risks relating to permanent establishment. This technology solution brings me a lot of value from a global mobility perspective, but also helps our finance, payroll and tax functions so that we can address business travel compliance issues holistically as a team.”

Becky Schlereth, Global Mobility, Travel & Expense Manager

Watlow

“We use Topia’s technology to improve our overall approach to business travel compliance. It’s really important for us to protect both the employee and the company during business trips and to make sure we’re proactively managing risks that can arise.”

Becky Schlereth, Global Mobility, Travel & Expense Manager

Watlow

“Topia has been a reliably strong partner for our Vistra global mobility team and end-users, providing accurate, user-friendly work location data. Topia’s team of support professionals is top notch and always responsive, knowledgeable and accommodating of our needs.”

Paul Rubino, Senior Director, US Expatriate Tax

Vistra

Request a demo

Our team of specialists will be happy to walk you through whichever aspects of the platform are going to benefit your organization most. Book a demo session with us to find out how our technology can:

- Enhance operational efficiency through process automation

- Improve employee satisfaction for moving or traveling team members

- Upgrade your approach to distributed work compliance

- Offer you powerful data and insights into your mobility programs and more

To see the Topia platform in action, fill out the form on the right and our team will be in touch.